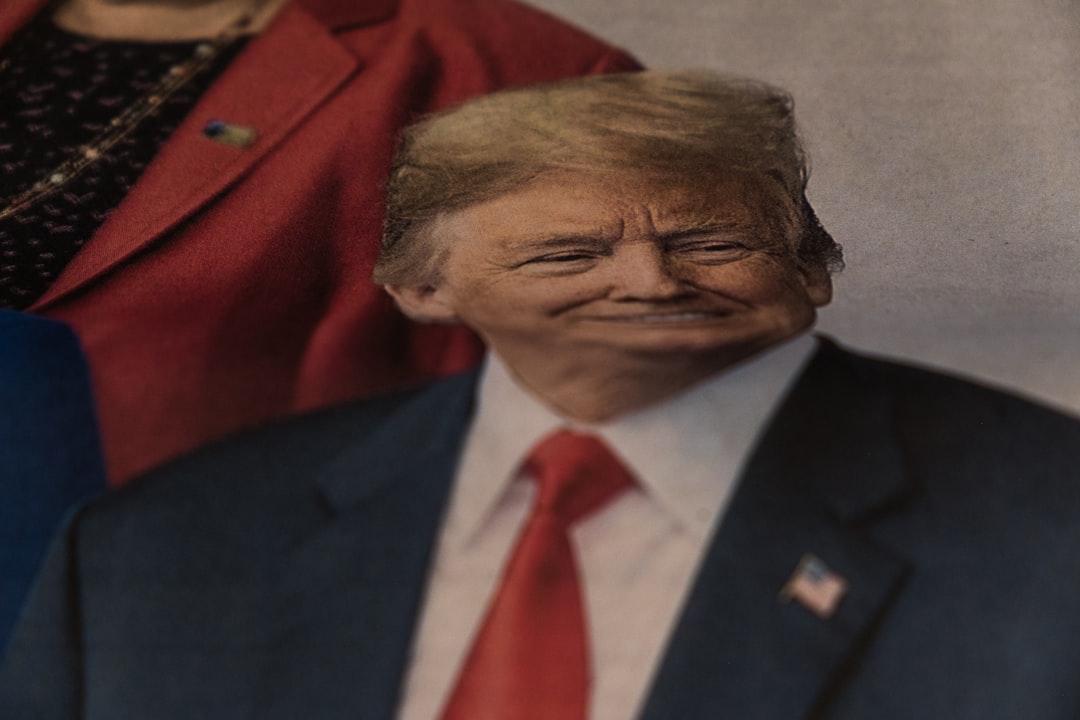

U.S. equities posted modest gains on Monday, buoyed by fresh comments from President Donald Trump that hinted at a potential de-escalation in trade tensions with key global partners.

The S&P 500 rose 0.1%, the Dow Jones Industrial Average added 88 points (+0.2%), while the NASDAQ Composite advanced 0.3%, closing at a record high of 20,640.33.

Despite laying out a barrage of trade tariffs — including a 30% levy on imports from Mexico and the European Union — Trump emphasized on Monday that the “letters are the deals,” signaling that his administration remains open to negotiations.

Use the SEC Filings API to track disclosures and filings that may reflect companies' tariff exposures, risks, and trade-related language in earnings reports.

Investors welcomed the rhetoric, especially with the August 1 tariff implementation deadline looming. The shift in tone sparked optimism that retaliatory tariffs might be avoided, reducing downside risk for global equities.

This week marks the official start of Q2 earnings season, with major financial firms ready to report. JPMorgan Chase, Bank of America, and Wells Fargo will headline early results.

Tech and healthcare giants like Netflix, Johnson & Johnson, and 3M are also set to report later in the week.

Stay ahead of the earnings calendar with the Earnings Calendar API, which provides upcoming earnings dates and estimates across sectors.

Separately, Fastenal (NASDAQ:FAST) jumped after beating Q2 estimates on both top and bottom lines, driven by strong demand for safety-related industrial supplies.

Market sentiment remains cautiously optimistic. While the S&P 500 flirted with gains on easing trade concerns, all eyes now turn to earnings results for forward guidance — especially amid macro risks from tariffs, inflation, and Fed policy uncertainty.