Taiwan Semiconductor Manufacturing Co (TW:2330) delivered a stellar second quarter, reporting sales of NT$933.8 billion ($31.9 billion) — a 39% year-over-year increase, driven by unrelenting demand for artificial intelligence (AI) chips.

The revenue figure exceeded market estimates (LSEG consensus: NT$927.83 billion) and topped TSMC’s own guidance range of $28.4 billion to $29.2 billion set in April. This performance reaffirms TSMC’s dominance as the world’s largest contract chipmaker, especially as the AI boom fuels unprecedented semiconductor demand.

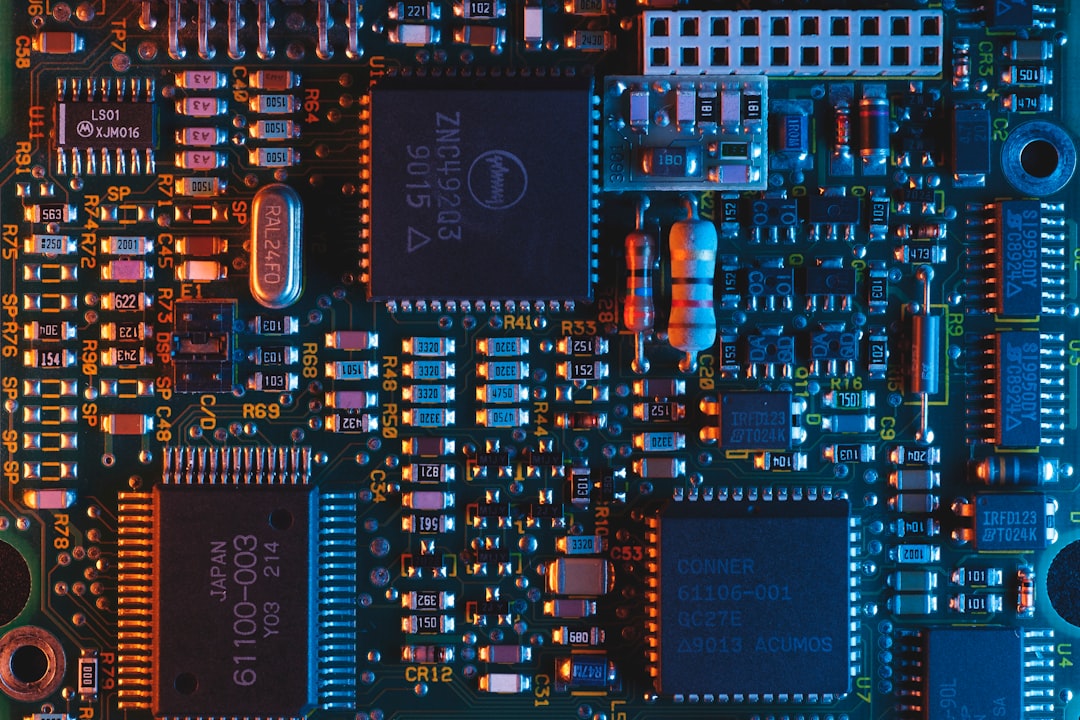

AI Boom: Clients like NVIDIA (NASDAQ:NVDA) and Apple (NASDAQ:AAPL) are ramping up orders for advanced chips used in AI workloads, from training large models to powering edge devices.

High-Performance Computing (HPC) and 5nm/3nm processes continue to lead TSMC’s revenue mix.

Supply chain normalization has allowed smoother delivery of large orders, avoiding 2022–2023 bottlenecks.

Notably, Nvidia’s historic $4 trillion market cap milestone this week underscores the sector’s momentum — and TSMC is central to that success.

TSMC will announce full Q2 earnings on July 17, including:

Net profit

Gross margin trends

Forward guidance (Q3 outlook)

Capital expenditure updates

Investors will be watching closely for margin commentary and updates on capacity expansion plans, particularly in Arizona and Japan.

Here are two valuable APIs to analyze TSMC's performance and valuation:

Revenue Product Segmentation API

→ Offers granular visibility into TSMC’s revenue mix by segment (e.g., 3nm, 5nm, HPC, automotive), helping analysts understand where growth is concentrated.

Ratios (TTM) API

→ Tracks profitability, return on equity, and capital efficiency metrics over time, ideal for benchmarking TSMC’s fundamentals against competitors like Samsung or Intel.

TSMC’s latest results highlight how central AI chip manufacturing has become to global tech infrastructure. As demand from Nvidia, Apple, and others grows, the company is not only outperforming but reshaping the semiconductor value chain.

With earnings coming up on July 17, investors should brace for another wave of insights that could move both chip and AI stocks.